Used Truck Financing: The Ultimate Guide for Buyers

Financing a used truck can be a game-changer for your transportation business, providing a cost-effective solution to expand your fleet. In this blog, you can learn about the process of securing a used truck loan, highlight the benefits, and explain why Truck Junction is the ideal platform for your financing needs. We will cover used truck financing, used commercial truck financing, used semi truck financing, used semi truck financing rates, and more.

Why Used Truck Financing?

There are several advantages to used truck financing. The up-front costs of financing a used truck are less than those of buying a new truck. Because of this, more of your capital can be invested in other essentials for your business. In addition, a used truck depreciates less than a new truck. Lenders also give better interest rates on used truck financing, which makes it more budget-friendly. Used truck loans are great ways for startups and small businesses to increase their fleet without posing an extraordinary burden on the owner’s pocket.

Used Truck Loans vs. New Truck Loans

When comparing used truck loans with new truck loan, several differences can be observed. As discussed in the above section, new truck loans generally have higher prices and depreciate faster. Also, used truck loans are easier and more budget-friendly and offer almost the same functionalities. Yes, newer trucks have advanced features, but used trucks will provide the same reliability and performance at a fraction of the cost. That turns used truck financing into a wise idea for many business owners. Therefore, knowing the differences helps one make an informed decision.

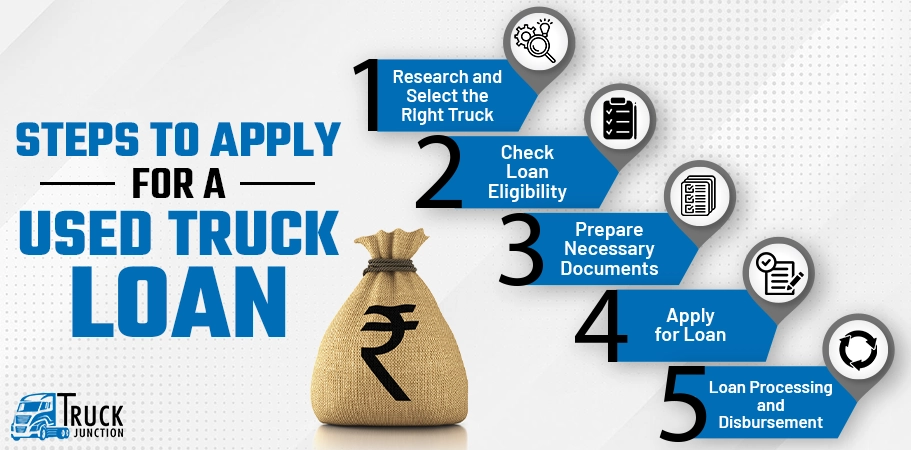

Steps to Apply for a Used Truck Financing

Step 1: Research and Select the Right Truck

Begin by researching used trucks that would suit your business. Check their specifications, condition, and cost. We offer a wide array of commercial vehicles, making it easier to find the perfect match. Look out for well-maintained trucks with good service records. This initial research period is very important because it forms the basis for a successful purchase and financing experience.

Step 2: Check Loan Eligibility

Before applying, ensure that you at least fit the basic eligibility criteria for applying for a used truck loan. This generally means that you must have a stable source of income and a good credit score. However, if your credit score is not that good or bad, then there is no need to worry. You can get several other lenders that will offer used truck financing bad credit as well. Therefore, knowing your eligibility should help smooth the process of applying. Keep all relevant documents proving your financial stability and creditworthiness ready.

Step 3: Prepare Necessary Documents

Prepare the necessary documents, including identity proof, address, income, and the vehicle’s details. Once all your documents are ready, the approval procedure will be fastened. Typical documents are your driving license, proof of address, income tax return, bank statement, etc. Double-check for any errors or omissions to avoid any delay in progress.

Step 4: Apply for Used Truck Financing

Now, you can apply for a loan without any hassle through our online platform. The form is self-explanatory and has been made to consume less of your time. Fill it out correctly to avoid any delays. Online applications are initiated with coherent step-by-step guides that help you through the application process. After completing the form, be assured that the application will be quickly processed by the concerned team.

Step 5: Loan Processing and Disbursement

On approval, the loan amount will ensure quick disbursement so that you can buy your selected truck and grow your business. Our website system ensures faster access to your funds without any unnecessary delays. You can then go ahead and finalize the purchase of your truck as soon as possible. Quick fund turnover is very important for businesses intending to increase their fleets on time.

Why Choose Truck Junction for Used Truck Financing?

-

Instant Loan Approval

With instant approval on used truck loans, we ensure you do not need to waste too much time getting your vehicle. This feature of instant approval helps businesses looking to increase their fleet rapidly.

-

Flexible Tenure Options

Avail of flexible repayment tenure options suited to your financial situation to manage your finances more comfortably. We offer customized loan tenures that will help you keep your cash flow under control.

-

Attractive Interest Rates

The benefit of competitive interest rates will make your loan repayment affordable and hassle-free. At Truck Junction, get attractive, used truck financing rates to make sure you can finance your truck without ever having your business broken on bank interests. Lower interest rates translate to lower monthly installments, which provide more funds to be used for other business expenses. The same makes second-hand truck financing quite viable for businesses of all sizes.

-

Different Kinds of Vehicles

Truck Junction offers a huge platform with an inventory of more than 75 commercial vehicle brands to get the right used trucks for your business. Be it a pickup, semi-truck, or dump truck, Truck Junction has got your back. You could pick a vehicle that exactly serves your business’s needs. Moreover, we provide detailed specifications and price tags attached to each vehicle to ensure a well-thought-out decision.

-

Transparent Procedure

We ensure you an absolutely transparent loan process that is lucid, accurate, and free from any misconceptions. This transparency will help you gain confidence and know precisely what to expect at every step. Be it loan terms, interest rates, or fees, at our online platform, you can disclose everything right in front of you to avoid any last-minute surprises.

Tips for Choosing the Right Used Truck Financing

-

Compare Interest Rates

Always take quotes from different lenders and compare the rates of interest with each other. This step may save you a lot of money over the lifetime of the loan. A lower interest rate means a lower overall cost, and hence, you can afford your loan comfortably. You can use the used truck finance calculator that is available at Truck Junction’s official website to compare funds from multiple financing vehicles. This will help you know the total amount for every loan so you can know what you can afford to take.

-

Check Loan Terms and Conditions

Know the terms and conditions associated with the loan, including hidden fees or extra charges. Notice the payment schedule and whether it has penalties for early repayment. The lender should always be asked about loan processing fees, documentation fees, or late payment fees that may be charged on the loan. Knowing the fine details will help you organise your finances properly, avoiding costs incurred unnecessarily.

-

Evaluate Your Repayment Capacity

Ensure that the amount of the loan and its repayment schedule are not such that they may result in default. It should be aligned with the financial health of your business. Check your monthly income and expenditures to determine just how much you will be able to pay off every month comfortably. Flexible tenure options can help you find a repayment plan that will fit in your pocket. Also, evaluate the business revenue streams and how much they are going to increase in the near future to pay the installment easily without straining your pocket.

-

Consider Alternative Financing Options

If traditional loans don’t suit you, then look into alternative financing for used commercial trucks. This could involve lease financing or hire purchase agreements. This may be tailored to suit your business and, therefore, might have a lower cost in terms of the monthly payment. Discuss these options with your financial advisor to determine what best fits your business model.

Conclusion

Any transport company looking to amplify its fleet without incurring a high cost will execute the financing of a used truck as an initial step. We make this entire process effortless with instant approvals, flexible terms, and access to a wide range of vehicles. Ensure that you plan for the same and avail yourself of a used truck loan so that it can drive your business towards success. Financing a used truck was never an uphill task with the right approach and platform. Explore the offerings at Truck Junction today and take your first step to grow your business with a reliable used truck.

Common Questions About Used Truck Financing

Que. Can I Get Used Truck Financing with Bad Credit?

Ans. Yes, even with bad credit, you can get used truck financing. Many lenders, even Truck Junction, provide loans, especially for people with ultra-low credit scores.

Que. What Are the Typical Used Truck Finance Rates?

Ans. Used truck finance rates depend on many factors, including your credit score, loan amount, and repayment period. Truck Junction not only provides competitive interest rates but also makes financing more affordable.

Que. How Does the Used Truck Finance Calculator Work?

Ans. A used truck finance calculator can estimate your monthly payments. This calculation uses the loan amount, interest rate, and repayment period.

Related Blogs:

How to Apply For A Commercial Vehicle Loan?

Top 10 Benefits of Buying Used Trucks in India 2024