What is Commercial Vehicle Insurance? Types & Benefits

Having commercial vehicle insurance is crucial for businesses that involve transporting goods. No matter if your trucks are transporting raw materials or finished products, they must endure long trips, navigate through different types of terrain, and confront various weather conditions.

Further, it is important to make sure that deliveries are completed on time and successfully. Your trucks may experience damage from regular use, collisions, or unexpected events like natural disasters. These incidents may result in costly repairs and additional expenses.

A comprehensive commercial vehicle insurance policy helps protect your trucks and saves you money by covering these liabilities. Further, this way, you can keep your fleet and finances safe, no matter what challenges come your way. But what exactly does commercial vehicle insurance cover in detail?

This blog will, therefore, outline an overview of some of the best commercial vehicle insurance types and the benefits and coverages offered by each.

What is Commercial Vehicle Insurance?

Commercial vehicle insurance is a type of policy that covers everything from accidents and robberies to natural events and third party liabilities. Further, this insurance for commercial vehicles is fundamental for any business that depends on vehicles for its tasks. Also, this specific insurance policy offers extensive assurance for vehicles used in business activities.

The types and advantages of insurance commercial vehicles help organisations make informed decisions about the inclusions they need to shield their resources and guarantee smooth activities.

Commercial vehicle insurance is crucial because it provides monetary assurance and legal compliance. Also, these policies are fundamental for organisations that depend on vehicles for their tasks.

See Also: How to Choose Best Commercial Vehicles for Small Businesses

Commercial Vehicle Insurance: Types, Advantages, and Coverage

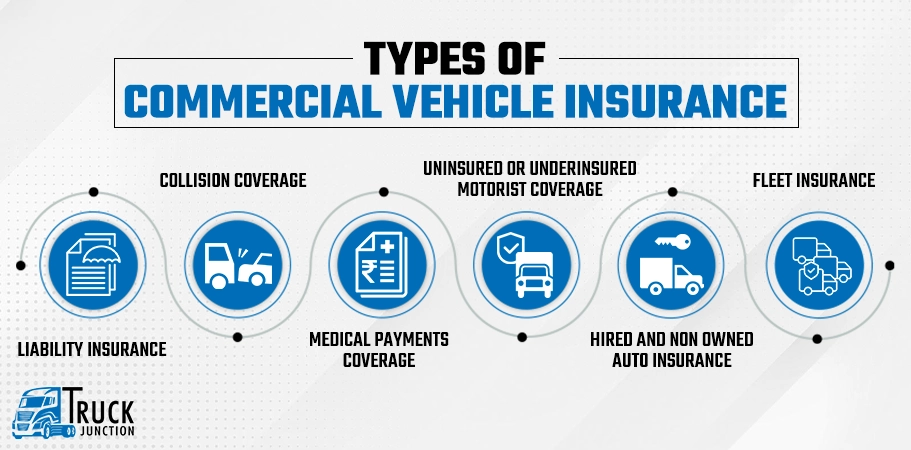

Types of Commercial Vehicle Insurance

1. Liability Insurance

Third Party Liability: This inclusion covers lawful liabilities emerging from wounds or harm caused to third parties. It’s obligatory in numerous areas and shields against claims from third parties who endure injury or property harm because of the incurred vehicle.

Comprehensive Liability: Commercial vehicle insurance third party extends coverage to incorporate both third party liabilities and harm to the damaged vehicle itself. This far reaching approach guarantees more extensive security.

2. Collision Coverage

This commercial vehicle insurance details the expense of fixing or replacing the guaranteed vehicle in case of a mishap, regardless of who is to blame. Collision coverage is pivotal for organisations that depend vigorously on their vehicles for everyday tasks.

3. Medical Payments Coverage

This online insurance commercial vehicle policy includes clinical costs incurred by the driver and passengers of the incurred vehicle in case of an accident. This guarantees that prompt clinical expenses are dealt with reducing the monetary burden on the business.

4. Uninsured or Underinsured Motorist Coverage

This inclusion safeguards against harm and wounds caused by drivers who either lack insurance or whose protection is inadequate to cover the expenses. It is fundamental for moderating dangers from uninsured or underinsured drivers.

5. Hired and Non Owned Auto Insurance

Covers vehicles that are leased, rented, or borrowed for business purposes. This type of protection is especially beneficial for organisations that occasionally use vehicles that are not their own.

6. Fleet Insurance

Fleet insurance is a complete strategy that covers various vehicles claimed by a business. It works on administration and frequently comes with money-saving advantages for organisations with a larger number of vehicles.

See Also: Types Of Commercial Vehicle In India – History & Benefits

Benefits of Commercial Vehicle Insurance

-

Financial Protection

Commercial vehicle insurance provides financial coverage for harm due to mishaps, robbery, defacing, and natural events. This assurance assists organisations in avoiding critical financial misfortunes that could emerge from such occurrences.

-

Legal Compliance

In numerous locales, having commercial vehicle insurance is a legitimate prerequisite. Ensuring consistency with these guidelines assists organisations in avoiding fines and legal confusion.

-

Peace of Mind

With the right commercial vehicle insurance policy entrepreneurs can focus on their core tasks without worrying about the risks associated with their vehicles. This inner peace includes better business planning and functional effectiveness.

-

Coverage for Employee Drivers

Commercial vehicle insurance frequently extends coverage to representatives who drive the safeguarded vehicles. This guarantees that both the business and its representatives are safe in case of a mishap.

-

Customised Policies

Insurance suppliers offer custom contracts tailored to the particular needs of various organisations. Whether it’s a small delivery service or an enormously coordinated factor organisation, strategies can be adapted to achieve the right degree of inclusion.

See Also: Types of Commercial Mobile Trucks in India – Business Ideas

Coverage Offered by Commercial Vehicle Insurance

1. Property Damage Liability

It covers the expense of harm caused to someone else’s property by the insured vehicle. Also, this can include fixing expenses and paying for the loss of purpose of the harmed property.

2. Bodily Injury Liability

Covers medical costs of third party physical injury, lost earnings and legal expenses where such an accident occurs in the insured car.

3. Personal Injury Protection

It entails medical expenses, repair costs, and wages lost by the guarded transport’s occupants, be they the driver, passengers, or any other user, irrespective of the level of negligence at which the accident occurred.

4. Physical Damage Coverage

This includes impact and extensive inclusion, guaranteeing that harm to the insured vehicle is covered whether it happens because of a mishap or different variables like burglary or natural events.

5. Cargo Coverage

It safeguards the goods being moved in the protected vehicle. Further, this is especially significant for organisations engaged in logistics and the transportation of important things.

6. Loss of Use Coverage

The advantages of commercial vehicle insurance are that it provides compensation for lost time when a commercial vehicle is unavailable because of covered repairs. Also, this guarantees that the business can keep up with tasks in spite of impermanent vehicle inaccessibility.

All in all, if you are looking for a commercial vehicle insurance plan for your organisation, it is imperative to understand the importance of commercial vehicle prices. Also, commercial vehicle insurance is a crucial part of organisations that depend on vehicles for their tasks. It provides financial security, legitimate consistency, and inner peace, permitting organisations to focus on their core activities. By understanding the types of coverage available and choosing the right approach, companies can guarantee that their vehicles, drivers, and cargo are all safeguarded.

See Also: Top 10 Small Commercial Vehicle in India

FAQs

1. How is Commercial Vehicle Insurance Renewal Online?

For commercial vehicle insurance renewal: First, go to the website of the insurance company that provides you with the insurance, read over all the details of the policy, make changes if require, decide on the renewal options, and then pay the renewal amount.

2. Which Insurance is Best for Commercial Vehicles?

The best insurance for commercial vehicles should provide wide-ranging coverage, reasonable rates, and good customer support.

3. How to Get Commercial Vehicle Insurance?

To obtain commercial automobile insurance, evaluate your requirements, identify companies, apply for quotes, compare the offers, select the most suitable policy, and acquire the policy.

4. What Does Commercial Vehicle Insurance Cover?

Types of commercial auto insurance include liability, physical damage, medical payment, uninsured or underinsured motorist, hired or nonowned automobiles, and cargo.

Related Blogs

Top 30 Commercial Vehicle Questions And Answers

How to Apply For A Commercial Vehicle Loan